The Mitsubishi UFJ Financial Group (MUFG) and Morgan Stanley are among global systemically important financial institutions (G-SIFIs). The greatest feature and strength of Mitsubishi UFJ Morgan Stanley Securities is our ability to freely use the abundant expertise and the networks, which rank among the largest in the world, of both companies. We provide solutions that offer a multi-faceted perspective together with outstanding quality to respond to the diverse financial needs of both retail and corporate clients.

Flexibly Leveraging the Comprehensive Capabilities Unique to the MUFG Group

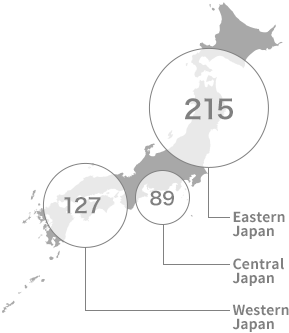

As the core general securities company in MUFG, we cooperate with other Group companies including MUFG Bank and Mitsubishi UFJ Trust and Banking. Flexibly leveraging the comprehensive capabilities of the Group that encompass a broad range of diverse financial products and services, we provide one-stop handling for various financial needs including matters such as asset succession as well as asset management.

Number of branches includes total branches of Mitsubishi UFJ Securities Holdings, Bank of Tokyo-Mitsubishi UFJ, Ltd.(currently MUFG Bank, Ltd.), and Mitsubishi UFJ Trust and Banking (as of September 30, 2024).

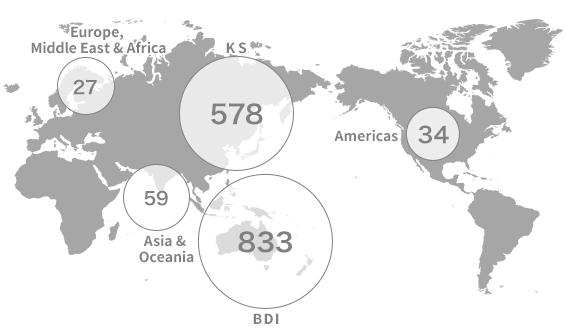

Making Morgan Stanley’s Global Reach an Even Greater Force for Clients

Since its inception in May 2010 as a joint venture of MUFG and Morgan Stanley, Mitsubishi UFJ Morgan Stanley Securities has steadily built up results in investment banking operations by making full use of its advanced proposal capabilities leveraging the global reach and outstanding products and services possessed by Morgan Stanley. Taking maximum advantage of Morgan Stanley’s network extending to 42 countries worldwide, we offer strategic, high-quality advice and propose funding procurement methods to support clients all the way to achievement of their long-term business goals. Collaboration and cooperation between Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities, as joint ventures of MUFG and Morgan Stanley, are not limited to the business front, but also include corporate social responsibility activities. This has allowed for the deepening of mutual understanding, and the two companies have become more solidly united.

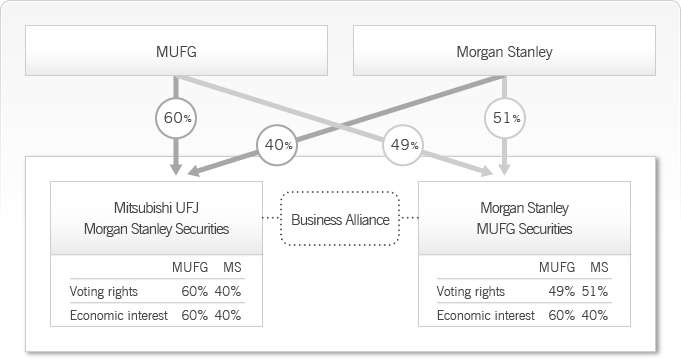

Power of Collaboration between MUFG and Morgan Stanley

The joint venture entities, Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities both established in May 2010, leverage the combined capabilities of Morgan Stanley’s global reach and financial expertise and MUFG’s unparalleled client footprint, collaborating closely and offering unprecedented financial services to clients. By doing so, the joint venture aims to become the top securities firm in Japan.

Since the launch of the joint venture, both entities have been collaborating closely in many aspects. The integrated investment banking team and respective capital markets teams have jointly scored solid wins on a number of notable transactions in the areas of M&A advisory and equity and debt offerings. Over the years, the collaboration has also extended to the area of wealth management.

In July 2023, Morgan Stanley and MUFG announced the launch of "Alliance 2.0", an enhanced Global Strategic Alliance for further collaboration between the two institutions. Through this initiative, the joint venture entities have integrated the Japanese research and equity businesses for institutional clients into Morgan Stanley MUFG Securities, enabling the joint venture to better serve clients with a more extensive range of financial services and products.

- Joint Venture Structure -

While the investment banking operations are integrated into Mitsubishi UFJ Morgan Stanley Securities, we believe the two-company structure is the most effective business model to optimize the joint venture entities’ ability to leverage their respective capabilities and provide our clients with the best possible service.

Mitsubishi UFJ Morgan Stanley Securities offers services to its retail customers that includes a wide range of unique product lineups leveraging Morgan Stanley’s global market expertise, in addition to conventional products and services they offered prior to the formation of the joint venture.

To corporate clients, the joint venture provides sophisticated services and solutions in M&A advisory, equity and debt underwriting and other products that can be realized through the collaboration between Morgan Stanley and MUFG, leveraging each of their extensive network and know-how.

Both Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities offer products and services through each of their sales and trading functions to corporate clients including institutional investors by leveraging their respective strengths and unique value propositions. With the launch of "Alliance 2.0", the two companies will be collaborating in the Japanese research and equity businesses for institutional clients to meet the increasingly sophisticated and diversifying needs of clients.

Two-Company Structure

MUFG holds a 60 percent interest in Mitsubishi UFJ Morgan Stanley Securities, while Morgan Stanley holds a 40 percent interest, making Mitsubishi UFJ Morgan Stanley Securities a consolidated entity of MUFG.

Morgan Stanley has a 51 percent voting interest (and 40 percent economic interest) in Morgan Stanley MUFG Securities, while MUFG has 49 percent voting interest (and 60 percent economic interest), making Morgan Stanley MUFG Securities a consolidated Morgan Stanley entity.

Through the cross-shareholdings and by sending officials as each entity’s management members, the joint venture entities are strongly bound together.

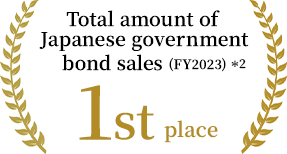

Awards

Mitsubishi UFJ Morgan Stanley Securities combines its expertise and skills to provide the best solutions to our clients. We have gained a high reputation and level of satisfaction from various clients.

*1. As of August 1, 2024 *2. Source: Ministry of Finance *3. Source: Domestic Fixed-Income Investors-2023 Greenwich Associates *4. Source: Compiled by Mitsubishi UFJ Morgan Stanley Securities based on Refinitiv. Publicly announced deals involving Japanese companies (including real estate acquisitions). Mitsubishi UFJ Morgan Stanley Securities includes deals for which Morgan Stanley acted as advisor (April 2023 to March 2024) *5. Source: Domestic bonds are created by Mitsubishi UFJ Morgan Stanley Securities based on Refinitiv and DealWatch database provided by Refinitiv. Compiled from league tables of lead managers of domestic bonds, including straight bonds, FILP agency bonds, etc. (including highway bonds), and municipal bonds. Foreign bonds are created by Morgan Stanley MUFG Securities based on data from corporate disclosure information, Dealogic, Bloomberg, IFR, and Informa (April 2023 to March 2024). *6. Source: Prepared by Mitsubishi UFJ Morgan Stanley Securities based on Refinitiv. Mitsubishi UFJ Morgan Stanley Securities includes the portion underwritten by Morgan Stanley MUFG Securities for equity underwriting by Japanese companies in the domestic market and the portion underwritten by Morgan Stanley for equity underwriting by Japanese companies in the overseas market (April 2023 to March 2024). *7. Source: Nikkei Veritas, March 10, 2024 *8. Source: Tokyo Stock Exchange/The Good Market Makers (March 2024) *9. Source: Asiamoney: Best Bank Awards 2023: Japan/Best Investment Bank, Best Bank for ESG. Note: Mitsubishi UFJ Morgan Stanley Securities and Morgan Stanley MUFG Securities were awarded as a securities joint venture (JV) between MUFG and Morgan Stanley in Japan. *10. Received the highest rating of three stars in the following two categories of HDI-Japan’s 2023 HDI Benchmark (Securities Industry) for the fifth year running: Phone Support (Contact Center) and Web Support (Website). *11. Received Gold Prize in the Financial Services (Securities) category at the fifth ESG Finance Awards Japan (Minister of the Environment Award) (announced on February 19, 2024) *12. Obtained Digital Transformation Certification in December 2022 in recognition of a proactive approach toward digitalization